At the end of a fiscal year, the accountants note the balance, but they do not close the account by zeroing it out. For example, the inventory balance from one year-end becomes the following year’s inventory balance. Likewise, the accounts payable balance shows the balance of your unpaid expenses. It does not show how much you’ve spent over the last quarter or year. That’s because it shows you how much goods you have at the moment, instead of over a certain month, year, a few years, or any other specific amount of time. Closing entries are taught in accounting classes to help students understand the accounting process and how financial information moves through the accounting software.

These transactions accumulate throughout the month or until the accounting period is over. That happens when you move the temporary account balances at the end of the year into a permanent account. Businesses can focus on three main comparisons to better understand the difference between temporary and permanent accounts. An expense account is a temporary account used to track the money a business spends on general costs such as rent, utilities, wages, and other necessary operational expenses. Some examples of revenue accounts include commission income, rental income, interest income, service revenue, and sales revenue. A revenue account is a temporary account used to track the money a business receives in exchange for the goods and services it provides to customers.

How Automation Can Enhance the Management of Temporary and Permanent Accounts

With little to no human involvement, automated accounting involves the use of software to speed up key financial procedures like account reconciliation and statement preparation. Your revenue account tells you you’ve earned $500,000 this year, and your accounts receivable says you still need to collect $15,000 from your customers. For example, if you wanted to know your revenue for 2022—that would be a temporary account—and in 2023, the balance would go back to $0. Instead, why not look at automating the entire process with the use of accounting software? If you’re looking for information on what application would be right for your business, be sure to check out The Ascent’s accounting software reviews. Maintaining accurate asset records is crucial since they can secure loans or investments and play a key role in determining your business’s net worth.

- Understanding the differences between permanent and temporary accounts is crucial to ensure error-free bookkeeping.

- The term “temporary account” refers to items found on your income statement, such as revenues and expenses.

- This account records the business’s costs, such as utilities, office supplies, payroll expenses and other operations-related items.

- Explore our schedule of upcoming webinars to find inspiration, including industry experts, strategic alliance partners, and boundary-pushing customers.

- These accounts are closed at the end of an accounting period to produce your net profit or loss.

Organizations use liability accounts to record and manage debts owed, including expenses, loans, and mortgages. Your success is our success.From onboarding to financial operations excellence, our customer success management team helps you unlock measurable value. Through workshops, webinars, digital success options, tips and tricks, and more, you will develop leading-practice processes and strategies to propel your organization forward.

Temporary Accounts vs. Permanent Accounts

Temporary accounts (or nominal accounts) are accounts that you close at the end of an accounting period. This means you don’t carry their balances over to the start of the next period. Closing entries are not needed when using accounting software like QuickBooks, Xero, or Freshbooks. Because accounting software allows for date-driven reports to present financial information for any specified period of time, closing entries as part of the accounting process are not prepared. Using temporary accounts will allow you to maintain proper track of your account balances.

Permanent accounts represent the worth of a company at a specific time and are also called real accounts. Asset, liability, and retained earnings accounts track a company’s history forever. These accounts take a picture of what the financial position of the company looked like at that moment in time. These accounts are called permanent accounts and they are never closed.

In fact, these accounts make it easier for businesses to track the achievement of milestones. Unlike temporary accounts, permanent accounts do not close at the end of the accounting period. Their balances remain, providing an ongoing record of each account’s cumulative activity.

This is especially important for small enterprises, which may need large sums of money when making expensive acquisitions or investments. Companies can develop ways to efficiently plan and manage their cash flow, which can lead to profitability by being aware of permanent and temporary accounts. Permanent accounts remain open through the end of the accounting period and carry over their cumulative balance to the following period.

Is rent a temporary account?

Simply sticking with ‘the way it’s always been done’ is a thing of the past. BlackLine’s foundation for modern accounting creates a streamlined and automated close. We’re dedicated to delivering the most value in the shortest amount of time, equipping you to not only control close chaos, but also foster F&A excellence.

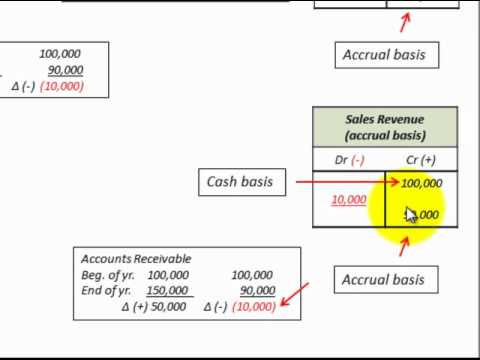

Unlike permanent accounts, temporary ones must be closed at the end of your company’s accounting period to begin the new accounting cycle with zero balances. This means that at the end of each accounting period, you must close your revenue, expense and withdrawal accounts. Temporary accounts include revenue accounts, expenses accounts, gain or loss on capital transactions accounts, memorandum accounts & any drawing account. Generally, these accounts are used to prepare the business’s Income statement. At the end of the period, closing entries are recorded to summarize the balance of the temporary accounts which gives us the net profit/loss made by the business for the period. This profit after distribution of dividend or any loss made is shown as part of reserves and surplus / retained earnings in the balance sheet & technically it is part of the owner’s equity.

Is accounts receivable permanent or temporary?

Accountants note the closing balance after the period, but the account is not terminated by resetting the amount to zero. Instead, when a new period starts, permanent accounts continue to be open and preserve their closing balance from the prior period. You may also choose to create a temporary income summary account, which helps with the end-of-the-year closing process. It’s where you combine all the other accounts and calculate net profit (or loss)—and transfer those funds to the right permanent accounts. Temporary accounts represent the current month’s activity, the revenue and expenses for current operations. In accounting, being able to run reports based on a time period is critical for understanding the relationship between revenue and expenses.

A temporary account in accounting records and tracks financial transactions that are expected to be reversed or eliminated at the end of an accounting period. It usually keeps track of revenues, expenses, gains, losses, withdrawals and deposits during a specific period. There is no predetermined fiscal period to maintain a temporary account, but it usually lasts for a year or less. Quarterly temporary accounts are fairly common, especially when it comes to tax payments or measuring the company’s financial performance.

Heroes Sports suit: Founder admits taking money from vet org – San Antonio Express-News

Heroes Sports suit: Founder admits taking money from vet org.

Posted: Tue, 22 Aug 2023 09:05:21 GMT [source]

Instead, the balance in these accounts are transferred at the end of the period to the appropriate permanent account. Whether you’re a small business bookkeeper or an accountant for a Fortune 500 company, all accounting transactions are recorded using these accounts. For instance, when you pay your monthly rent of $1,500, you are directly impacting both an asset and an expense account. Over a fiscal year, the temporary account starts with a zero balance on January 1. Through your bookkeeping, you record your company’s transactions during the year.

In this article, we will explore which accounts are not considered temporary in accounting and why they are essential to understand. We’ll also look at examples of non-temporary accounts and how they differ from their temporary counterparts. Finally, we will discuss the implications of misclassifying an account as either temporary or permanent. That same concept can be used to explain temporary and permanent accounts in accounting.

This information lets businesses make more informed decisions on budgeting and investment strategies by giving them insight into estimated future earnings. An equity account is a financial representation of business ownership accrued through company payments or residual earnings generated by an organization. Since our founding in 2001, BlackLine has become a leading provider of cloud software that automates and controls critical accounting processes. Whether you’re new to F&A or an experienced professional, sometimes you need a refresher on common finance and accounting terms and their definitions. BlackLine’s glossary provides descriptions for industry words and phrases, answers to frequently asked questions, and links to additional resources. Understand customer data and performance behaviors to minimize the risk of bad debt and the impact of late payments.

In order to have accurate financial statements, you must close each temporary account at the end of the accounting period. Temporary accounts in accounting are used to record financial transactions for a specific accounting period. At the end of that period, all balances in temporary accounts must be transferred to permanent accounts.

At the end of the period, its balance is transferred to the Cost of Goods Sold (COGS) account. Here, the accountants record the closing balance at the end of a fiscal period. These accounts never shut down and remain active throughout the business. As a result, when the new fiscal period begins, the account maintains the closing balance from the preceding fiscal period.

Temporary accounts can last for a quarter or a year, depending on the organization’s needs. Quarterly temporary accounts are useful for monitoring financial success and tax payments. These accounts provide an efficient way for businesses to track their progress and achievements over time. Temporary accounts, also known as nominal accounts, are financial accounts used to record specific transactions for a fixed period.